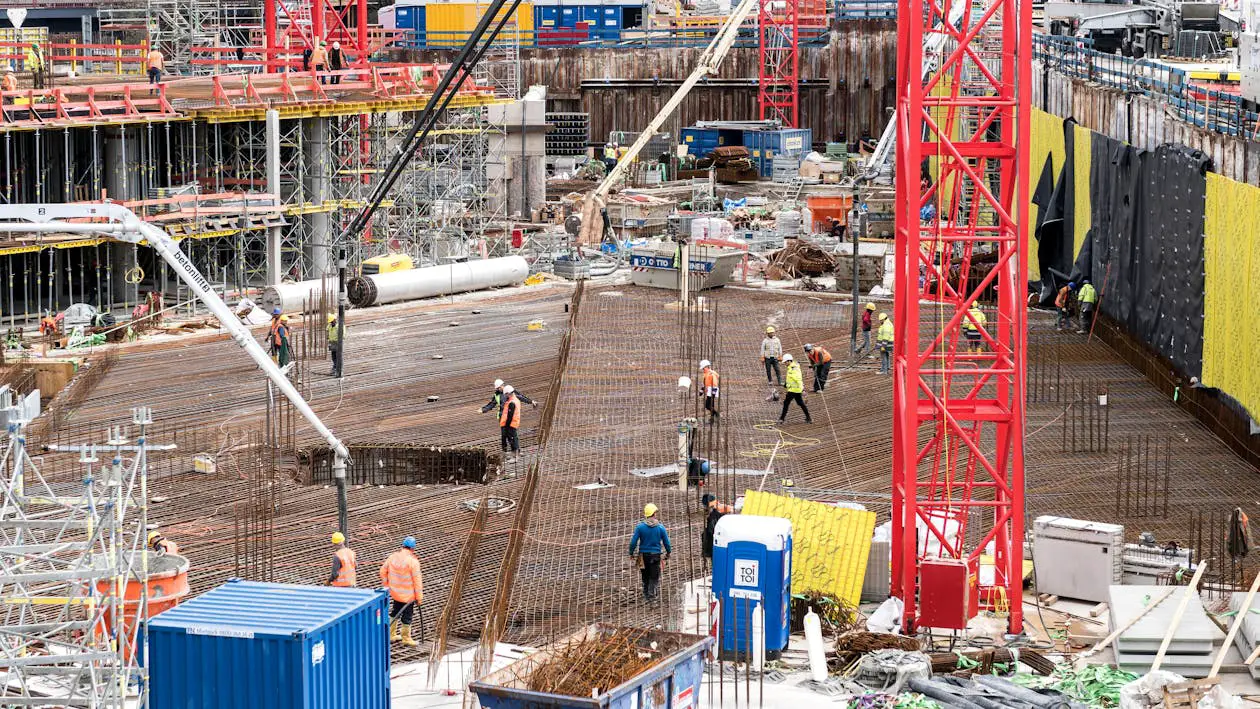

In the digital age, the landscape of work is rapidly evolving. With the rise of freelance platforms and the gig economy, more individuals are opting for flexible work arrangements that offer autonomy and independence. While the gig economy provides countless opportunities for earning income on one’s own terms, it also comes with its own set of challenges and risks. One of the most critical aspects for freelancers and gig workers to consider is insurance coverage. In this blog post, we’ll explore specialized insurance options tailored to the unique needs of freelancers and gig workers, providing peace of mind and protection in an ever-changing work environment.

Understanding the Gig Economy Landscape

Before delving into specialized insurance options, it’s crucial to understand the nature of the gig economy and why traditional insurance may not suffice for freelancers and gig workers. The gig economy encompasses a wide range of industries, from ride-sharing and delivery services to freelance writing and graphic design. Unlike traditional employment, gig workers often lack access to employer-sponsored benefits such as health insurance, disability coverage, and workers’ compensation.

Additionally, gig workers typically operate as independent contractors, meaning they are responsible for managing their own finances, taxes, and insurance needs. This level of autonomy provides freedom and flexibility but also requires careful consideration of risk management strategies, including insurance coverage.

Specialized Insurance Options for Freelancers and Gig Workers

- Health Insurance: Health insurance is a top priority for freelancers and gig workers, given the rising costs of medical care. While traditional employer-sponsored plans may not be available, there are several options to consider:

- Health Savings Accounts (HSAs): HSAs allow individuals to save for medical expenses tax-free. Freelancers can contribute pre-tax income to an HSA and use the funds to cover eligible healthcare costs.

- Individual Health Insurance Plans: Freelancers can purchase individual health insurance plans through state or federal marketplaces or directly from insurance providers. These plans offer flexibility in coverage options and premiums based on individual needs.

- Healthcare Sharing Ministries: Some freelancers may opt for healthcare sharing ministries, which involve pooling resources with other members to cover medical expenses. While not traditional insurance, these arrangements can provide cost-effective alternatives for certain individuals.

- Disability Insurance: Disability insurance is crucial for protecting against lost income in the event of illness or injury that prevents a freelancer from working. Traditional disability insurance policies may be prohibitively expensive for some freelancers, but there are alternatives to consider:

- Short-Term Disability Insurance: Short-term disability insurance provides income replacement for a limited period, typically ranging from a few months to a year. These policies offer more affordable premiums than long-term disability insurance and can provide temporary financial support during recovery.

- Association-Based Disability Insurance: Freelancers may have access to disability insurance through professional associations or industry groups. These group policies often offer competitive rates and tailored coverage options for self-employed individuals.

- Liability Insurance: Liability insurance protects freelancers and gig workers from potential legal claims and financial losses arising from their work activities. Depending on the nature of their work, freelancers may require different types of liability coverage:

- General Liability Insurance: General liability insurance provides coverage for bodily injury, property damage, and advertising injury claims. It’s essential for freelancers who interact with clients or work on-site at various locations.

- Professional Liability Insurance: Also known as errors and omissions (E&O) insurance, professional liability insurance protects freelancers from claims of negligence, errors, or omissions in their work. It’s particularly valuable for consultants, designers, and other professionals who provide specialized services.

- Cyber Liability Insurance: In an increasingly digital world, cyber liability insurance is essential for freelancers who handle sensitive client data or operate online businesses. This coverage protects against data breaches, cyberattacks, and other cyber risks that could result in financial losses or reputational damage.

- Workers’ Compensation Insurance: While traditional workers’ compensation insurance is designed for employees, freelancers and gig workers can still obtain coverage to protect themselves against work-related injuries or illnesses:

- Occupational Accident Insurance: Occupational accident insurance provides benefits similar to workers’ compensation for independent contractors and gig workers. It covers medical expenses, disability benefits, and accidental death and dismemberment benefits resulting from work-related incidents.

Conclusion: Securing Your Future in the Gig Economy

As the gig economy continues to expand, freelancers and gig workers must prioritize insurance coverage to protect themselves against unforeseen risks and liabilities. While navigating the complexities of insurance can be daunting, there are specialized options available to meet the unique needs of independent contractors and self-employed individuals.

From health and disability insurance to liability and workers’ compensation coverage, freelancers have access to a range of solutions tailored to their specific circumstances. By understanding their insurance needs and exploring available options, freelancers can safeguard their financial well-being and pursue their passions with confidence in the dynamic world of the gig economy.